Navigating the world of taxes can often feel like wandering through a maze. One crucial element that can help simplify your tax filing process is Form 16. But what is Form 16? If you’ve ever wondered about this essential document, you’re in the right place!

In this comprehensive guide, we’ll unravel everything you need to know about what is Form 16?—from its purpose and eligibility criteria to how to obtain it online. Whether you’re an employee or a freelancer, understanding Form 16 will empower you to manage your finances effectively. Let’s dive into the details!

What is Form 16?

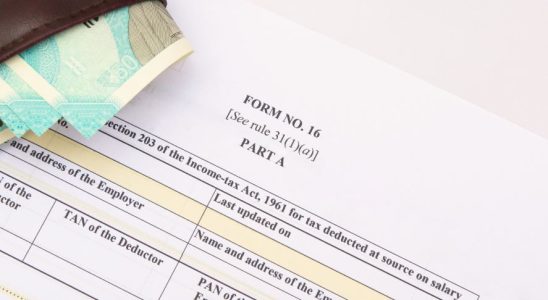

Form 16 is a crucial document in India that serves as a certificate of tax deducted at source (TDS) for salaried individuals. It is issued by employers to their employees and provides a detailed summary of the salary earned during the financial year, along with the amount of TDS deducted.

This form is typically divided into two parts: Part A contains information such as the employer’s and employee’s details and the TDS amount, while Part B includes a comprehensive breakdown of the salary components and deductions claimed under various sections of the Income Tax Act.

Form 16 is essential for employees to file their income tax returns accurately, as it helps them understand their taxable income and verify the TDS deducted against their earnings.

What is Form 16 Used For?

Form 16 serves several important purposes for salaried individuals.

- Primarily, it acts as a proof of income that details the salary and tax deducted at source (TDS) by employers. This document is essential when preparing your annual income tax return.

- Additionally, Form 16 simplifies the process of filing taxes. It provides a clear breakdown of earnings, deductions, and TDS paid throughout the financial year. This makes it easier for taxpayers to understand their taxable income.

- Another significant use of Form 16 is its utility in obtaining loans or mortgages. Financial institutions often request this form to verify an individual’s income stability before granting credit facilities.

How to Get Form 16 Online?

Getting Form 16 online is a straightforward process.

- First, you need to visit your employer’s official website or the income tax department’s portal. Most companies provide this document through their employee self-service portals.

- Once you’re on the site, log in using your credentials. Navigate to the section related to salary or tax documents, where you’ll find an option for downloading Form 16.

- If your employer doesn’t offer online access, you can request it via email or direct communication. Ensure that all details are accurate before finalizing any download so that there are no discrepancies when filing your taxes later on.

Eligibility Criteria for Form 16

Form 16 is primarily for salaried individuals in India, and certain eligibility criteria must be met for an employee to receive this certificate from their employer. Here are the key eligibility criteria for Form 16:

- Salary Income:

The individual must be a salaried employee, meaning they receive a salary from an employer.

- Tax Deducted at Source (TDS):

The employer must have deducted TDS from the employee’s salary during the financial year. Form 16 is issued if TDS has been deducted and deposited with the government.

- Income Threshold:

While there is no specific minimum income limit for receiving Form 16, employees earning more than the basic exemption limit (which varies based on age and category) are more likely to have TDS deducted. For the financial year 2023-24, the basic exemption limit is ₹2.5 lakh for individuals below 60 years of age.

- Employment Status:

The employee must be currently employed or have been employed during the financial year for which Form 16 is being issued.

- Employer Responsibility:

It is the employer’s responsibility to issue Form 16 to employees who meet the above criteria. Employers must provide this form by June 15 of the financial year following the one for which it is issued.

- Multiple Job Holders:

If an individual has multiple employers during the financial year, they should receive separate Form 16s from each employer for the salary earned.

To be eligible for Form 16, you need to be a salaried employee with TDS deducted from your salary by your employer. Ensuring that these criteria are met will allow you to receive Form 16, which is essential for filing your income tax return accurately.

How to Download Form 16?

Downloading Form 16 can typically be done through your employer’s portal or via email if they provide it electronically. Here’s a step-by-step guide on how to download Form 16:

From Employer’s Portal:

- Visit the Employee Portal: Go to your company’s employee portal or HR management system.

- Login: Use your credentials (employee ID and password) to log in.

- Find the TDS or Tax Section: Navigate to sections labelled ‘Tax,’ ‘TDS,’ or ‘Form 16’. This may vary depending on your employer’s system.

- Select the Financial Year: Look for the option related to Form 16 and select the financial year for which you need the form.

- Download the Form: Click on the download link or button to get the Form 16 in PDF format. Make sure to save it to a secure location on your device.

From Email:

- Check Your Inbox: Look for an email from your HR department or finance office around the end of the financial year, as they often send Form 16 via email.

- Open the Email: Locate the email containing your Form 16 and open it.

- Download the Attachment: If the form is attached, click on the attachment to download it to your device. If it’s available as a link, click the link to download it.

If You Cannot Access:

Contact HR/Finance: If you’re unable to find Form 16 through the portal or email, reach out to your HR or finance department. They can assist you in obtaining the document.

Always ensure that you keep your Form 16 secure and verify the details for accuracy, as it is essential for filing your income tax return.

Details of Form 16 When Filing ITR Return

Form 16 is crucial when filing your Income Tax Return (ITR). It serves as proof of income and contains details of TDS deducted by the employer. This document is generated annually, reflecting your earnings for the financial year.

When you file your ITR, you’ll need to provide the figures from Form 16, including gross salary, deductions under various sections like 80C or 80D, and taxable income.

Accurate information in Form 16 ensures that you claim all eligible deductions while avoiding discrepancies with tax authorities. Therefore, always double-check these details before submitting your return to ensure compliance and accuracy.

Points to Consider While Checking Form 16

- When checking your Form 16, start by verifying all personal details.

- Ensure that your name, PAN number, and address are correct. Any discrepancies can lead to issues when filing your tax return.

- Next, pay attention to the income details mentioned in the form. This includes salary components like basic pay, allowances, and bonuses. Make sure these figures match what you received throughout the financial year.

- Review the TDS deductions listed on Form 16 carefully. Confirm that they align with your payslips or other records. Inaccuracies here could result in penalties or delays during tax processing.

When will Form 16 be Available for FY 2024-25?

Form 16 for the financial year 2024-25 is typically issued by employers after the end of the fiscal year, which runs from April 1 to March 31. Expect it to be available around May or June of 2025. Employers need time to compile and verify tax details before issuing this crucial document.

It’s essential to keep in touch with your HR or finance department regarding its availability. They will inform you once Form 16 is ready for distribution.

If you’re eagerly anticipating its arrival, staying organized can help. Be prepared with all necessary documents so you can file your Income Tax Return promptly once you receive Form 16.

Conclusion

Form 16 is a crucial document for salaried individuals in India. It serves as proof of income and tax deductions made throughout the financial year. Understanding its components can simplify your tax filing process.

Knowing how to obtain, download, and utilize Form 16 effectively can make a significant difference when managing your finances. With the right information at hand, you can ensure compliance with tax regulations while maximizing potential refunds.

Empowering yourself with knowledge about Form 16 not only aids in smoother tax filings but also enhances overall financial literacy. As you navigate through these details, you’ll be better equipped to handle future financial responsibilities seamlessly.

Frequently Asked Questions

Who issues Form 16?

Employers are responsible for issuing this form to their employees. They must provide it annually after the financial year ends.

Is Form 16 mandatory for filing ITR?

While it’s not mandatory, having Form 16 simplifies your tax return process. It provides detailed income and deduction information that can ease your calculations.

Can I file my return without Form 16?

Yes, you can file your return without it. However, you’ll need alternative documents like payslips or bank statements to verify your income.

When should I expect my Form 16 from my employer?

Typically, employers issue Form 16 by May each year for the previous financial year.