In the Indian business ecosystem of 2026, every rupee saved on overheads is a rupee reinvested in growth. For a long time, premium business credit cards were associated with hefty annual fees and complex eligibility.

However, the rise of the India Stack, integrated RuPay-UPI payments, and a push for MSME digitization has led to a new era, the age of high-reward, no-annual-fee business credit cards.

Whether you are a freelancer managing your first set of clients or a growing enterprise handling crores in monthly turnover, a business credit card is no longer just a payment tool, it is a short-term, interest-free working capital engine.

In this exhaustive 2026 guide, we analyze the top 12 business credit cards that offer either Lifetime Free (LTF) status or easy spend-based fee waivers, ensuring you never have to pay for the privilege of spending your own business capital.

Is a Business Credit Card with No Annual Fee Actually “Free”?

Before we dive into the list, it is vital to understand the “Indian math” behind no-fee cards in 2026.

LTF vs. Annual Fee Waivers: Which is Better for Your Turnover?

- Lifetime Free (LTF): These cards have ₹0 joining fee and ₹0 annual fee for life, regardless of how much you spend. These are ideal for micro-businesses or as “backup” cards.

- Spend-based Waiver: These cards carry an annual fee (e.g., ₹500 or ₹1,000), but the bank waives it if you meet a specific spending milestone (e.g., ₹50,000 in a year). For an active business, these are effectively “free” because business expenses usually far exceed these limits.

Hidden Costs to Watch for in 2026

Even “free” cards carry costs if not managed correctly:

- Forex Markup: If you pay for international software (like AWS or Zoom), a 2% to 3.5% markup can add up.

- Reward Redemption Fees: Many Indian banks now charge ₹99 plus GST every time you redeem your reward points.

- Utility Surcharges: As of 2026, several banks have introduced a 1% fee on utility or rental payments exceeding certain monthly thresholds.

Top 12 Business Credit Cards with No Annual Fee in India (Detailed Reviews)

Here is our curated list for 2026, ranked by their utility for different business profiles.

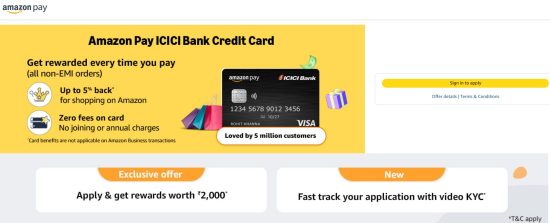

1. Amazon Pay ICICI Credit Card

Best For: E-commerce sellers and micro-SMEs who shop heavily on Amazon.in.

-

The “Free” Status: True Lifetime Free (LTF).

-

Detailed Rewards: * 5% Unlimited Cashback for Amazon Prime members (3% for non-prime).

-

2% Cashback on 100+ partner merchants (Swiggy, Uber, etc.).

-

1% Cashback on all other spends.

-

-

The 2026 Edge: This is arguably the most popular “un-official” business card in India. While marketed as a personal card, its unlimited 5% cashback on office supplies, electronics, and inventory purchased via Amazon makes it a powerhouse for small offices.

2. HDFC BizFirst Credit Card

Best For: MSMEs looking for the best RuPay-UPI integration.

-

The “Free” Status: Annual fee waived on spending just ₹50,000 in a year.

-

Detailed Rewards:

-

3% CashPoints on EMI spends.

-

2% CashPoints on Utility bills, Electronics, and SmartPay transactions.

-

1% CashPoints on all other retail spends, including UPI payments.

-

-

The 2026 Edge: Since this is a RuPay card, you can link it to BHIM or Google Pay and pay merchants via UPI. You earn rewards on UPI transactions, which was previously impossible.

3. IDFC FIRST Select Business Card

Best For: High-spending professionals who want premium perks without the price tag.

-

The “Free” Status: True Lifetime Free (LTF).

-

Detailed Rewards:

-

10X Rewards on incremental spends above ₹20,000 per month.

-

6X Rewards on online spends (up to ₹20,000).

-

1X = 1 Reward Point per ₹150 spent (1 RP = ₹0.25).

-

-

The 2026 Edge: It offers complimentary domestic airport lounge access (2 per quarter) and railway lounge access, provided you met the previous month’s spending criteria. It’s rare to find an LTF business card with these travel perks.

4. Axis Bank My Business Credit Card

Best For: Sole proprietors who need high rewards on specific business categories.

-

The “Free” Status: Often offered as LTF during digital application drives; otherwise, fee is waived on annual spends of ₹50,000.

-

Detailed Rewards:

-

4 Reward Points per ₹200 on Travel, Hotels, and Direct Marketing.

-

Base rate of 1 point per ₹200 on other spends.

-

-

The 2026 Edge: It provides a unique “Management Information System” (MIS) report that categorizes your business spends, making tax filing via GST portals much faster.

5. AU Bank Business Cashback RuPay

Best For: Retailers and traders who want flat cashback on all dues.

-

The “Free” Status: Monthly fee of ₹99 is waived on spending ₹10,000 per month.

-

Detailed Rewards:

-

1% Flat Cashback on the repayment of the total amount due (up to ₹1,000/month).

-

Railway Lounge Access: 8 complimentary visits per year.

-

-

The 2026 Edge: The 1% cashback on repayment is a unique mechanic that ensures you get rewarded for being a disciplined borrower.

6. ICICI Bank Business Advantage Blue

Best For: Lean startups looking for automated cashback.

-

The “Free” Status: Fee waived on annual spends of ₹5,00,000.

-

Detailed Rewards:

-

Up to 1% Cashback on domestic and international spends (tiered based on monthly volume).

-

Additional 0.20% Cashback if you pay the card bill through ICICI Corporate Net Banking.

-

-

The 2026 Edge: It includes a “Corporate Liability Waiver” insurance, protecting the business owner against unauthorized usage by employees if add-on cards are issued.

7. HDFC Business MoneyBack+

Best For: General retail and small-scale manufacturing.

-

The “Free” Status: Fee waived on annual spends of ₹50,000.

-

Detailed Rewards:

-

10X Reward Points on Amazon, Flipkart, and select business software.

-

5X Reward Points on fuel and utilities.

-

-

The 2026 Edge: You can redeem Reward Points directly against your statement balance (100 points = ₹20), essentially using your rewards to pay off your debt.

8. Kotak Biz Business Credit Card

Best For: Digital-heavy businesses (SaaS, Marketing, Ads).

-

The “Free” Status: Annual fee waived on spends of ₹50,000.

-

Detailed Rewards:

-

Up to 8 Reward Points per ₹150 on specific business categories.

-

Milestone Benefit: 10,000 Reward Points or 4 PVR tickets every 6 months on spending ₹1.25 Lakh.

-

-

The 2026 Edge: Kotak’s expense management tool allows you to set “Merchant Category” blocks, for example, you can prevent employee cards from being used at entertainment venues.

9. YES Prosperity Business Card

Best For: Service professionals with high travel and dining needs.

-

The “Free” Status: Low annual fee (₹399) waived on spending ₹50,000.

-

Detailed Rewards:

-

8 Points per ₹200 on Travel and Dining.

-

4 Points per ₹200 on other categories.

-

-

The 2026 Edge: Includes a “Credit Shield” cover of ₹1 Lakh in case of accidental death of the primary cardholder.

10. SBI Platinum Corporate Card

Best For: Established MSMEs with 5+ employees.

-

The “Free” Status: Zero Annual Fee (standard for most corporate tie-ups).

-

Detailed Rewards:

-

Focuses on Savings via Control rather than points.

-

Uses Visa Intellilink to provide deep analytics into where company money is going.

-

-

The 2026 Edge: SBI remains the king of “Public Sector” trust. If your business deals with government tenders, having an SBI Corporate card often simplifies the “Financial Capacity” proof.

11. HSBC Platinum Business Card

Best For: Businesses with international vendors or frequent global travel.

-

The “Free” Status: True Lifetime Free (LTF).

-

Detailed Rewards:

-

2 Reward Points per ₹150.

-

3-month Swiggy One Membership as a welcome gift.

-

-

The 2026 Edge: The 2:1 air mile conversion ratio for international airlines (Singapore Airlines, British Airways, etc.) is excellent for a zero-fee card.

12. Zet (SBM Bank) FD-Backed Card

Best For: New startups or individuals with a low CIBIL score.

-

The “Free” Status: Lifetime Free.

-

How it works: You open a Fixed Deposit (as low as ₹5,000) and get a credit limit of 90% of the FD amount.

-

The 2026 Edge: In 2026, building a business CIBIL score is crucial. This card allows you to earn interest on your FD while building the credit history needed to get the “unsecured” cards listed above.

How to Choose the Right No-Fee Card for Your Business?

| Feature | Best For E-commerce | Best For Travel | Best For UPI | Best For Accounting |

| Card Name | Amazon Pay ICICI | IDFC FIRST Select | HDFC BizFirst | Axis My Business |

| Primary Perk | 5% Unlimited Cashback | Free Lounges | UPI Rewards | MIS Spend Reports |

| Fee Waiver | LTF (Always Free) | LTF (Always Free) | ₹50k annual spend | LTF/Digital Drive |

The RuPay Advantage: Why your 2026 card must support UPI?

In 2026, India has largely moved away from swiping plastic at small merchant points. If your business card is a RuPay variant (like the HDFC BizFirst or AU Cashback), you can link it to your UPI app.

This allows you to pay your local chai-wala, stationery shop, or hardware store using credit, earning rewards on small-ticket expenses that were previously “cash-only.”

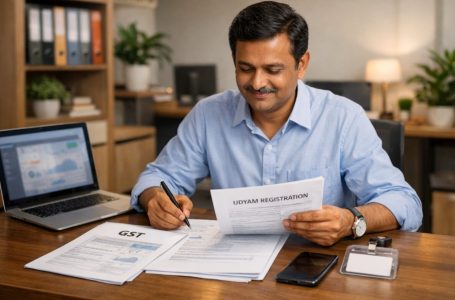

What are the Eligibility Requirements for a No-Fee Business Card in 2026?

Banks have streamlined the process, but the “Big Three” requirements remain:

- Udyam Registration: You must have an active Udyam certificate to prove you are an MSME.

- GST Returns: For unsecured cards, banks typically look for 12 months of GSTR-3B filings to verify your business turnover.

- FIT Rank: Lenders now use the Financial, Income, and Trade (FIT) Rank provided by CIBIL to assess business health beyond just a personal credit score.

Can You Earn Rewards While Paying GST and Income Tax?

This is the most common question for Indian business owners.

- The Reality: Most banks have excluded “Government & Tax Payments” from earning reward points in 2026.

- The Strategy: Some cards, like the HDFC BizFirst, still offer 1% CashPoints on tax payments up to a monthly cap. Even if you don’t earn rewards, using a small business line of credit or a credit card to pay taxes can help you manage your “Input Tax Credit” (ITC) cycle without dipping into your primary savings.

Conclusion

If you are just starting out, the Amazon Pay ICICI Card is a no-brainer for its simplicity and LTF status. However, if you want to leverage the 2026 digital payment ecosystem, the HDFC BizFirst RuPay card is the superior choice for its UPI rewards.

Remember, the goal of a “No Annual Fee” card is to reduce your cost of capital. Choose a card that aligns with your highest spending category, whether that’s Facebook Ads, Amazon inventory, or local vendor payments via UPI.

FAQs

Which business credit card is lifetime free in India?

The Amazon Pay ICICI Card, IDFC FIRST Select Business, and HSBC Platinum Business are the top True Lifetime Free (LTF) options available in 2026.

Can I get a business credit card on my GST number?

Yes. Most banks now offer GST-based credit cards where the credit limit is calculated as a percentage of your annual GST turnover.

Do these no-fee cards offer airport lounge access?

Only a few do. The IDFC FIRST Select Business and ICICI Business Advantage Blue (with spend criteria) are your best bets for lounge access without an annual fee.

Is it better to use a personal LTF card for business?

While tempting, it is a bad idea. Mixing personal and business spends makes your MSME accounting a nightmare and can lead to issues during tax audits.