Receiving an income tax notice can be an unsettling experience for salaried employees. Many taxpayers, despite diligent tax filing, may find themselves receiving a notice from the Income Tax Department.

Understanding the nature of these notices, the reasons behind them, and how to respond appropriately is crucial to avoid unnecessary stress and financial penalties.

In this detailed guide, we will explore the types of income tax notices that salaried employees might receive, the reasons behind them, the process to respond effectively, and how to avoid them in the future. By the end of this article, you will be equipped with the knowledge to handle any tax notice confidently and efficiently.

What Are the Types of Income Tax Notice for Salaried Employees?

Understanding the different types of income tax notices can help salaried employees respond appropriately and within the stipulated time. Each type of notice serves a specific purpose and demands different actions. Here are the most common types of income tax notices:

1. Notice under Section 139(9) – Defective Return

This notice is issued when the Income Tax Department identifies discrepancies or missing information in your Income Tax Return (ITR). It typically means your return is considered “defective,” and you are required to rectify the errors within a specified timeframe.

Common reasons for receiving Section 139(9):

- Incomplete or inaccurate income details.

- Mismatches in TDS (Tax Deducted at Source) data.

- Incorrect declaration of exemptions or deductions.

To resolve this, you must log in to the Income Tax e-filing portal, navigate to the “e-Proceedings” section, and correct the identified issues. If not addressed within the given period, your ITR may be treated as invalid.

2. Notice under Section 143(1) – Intimation Notice

The intimation under Section 143(1) is essentially a summary of the Income Tax Department’s assessment of your filed return. It compares your tax calculations with theirs and highlights discrepancies, if any.

Types of intimations under Section 143(1):

- No Demand, No Refund: Your filed ITR matches the department’s calculations.

- Refund Determined: You are eligible for a tax refund based on excess tax paid.

- Demand for Additional Tax: There are discrepancies, and you owe additional tax.

If you disagree with the calculations, you can respond online by providing the necessary proof to support your claims.

3. Notice under Section 143(2) – Scrutiny Assessment

A scrutiny assessment notice is more detailed and involves a thorough examination of your income, deductions, and tax payments. This notice is generally issued if the Income Tax Department suspects discrepancies or under-reporting of income.

Purpose of Section 143(2) notice:

- To verify the correctness of the income declared.

- To cross-check deductions claimed under various sections.

- To ensure proper calculation of tax liabilities.

Responding to this notice may require you to provide supporting documents such as salary slips, bank statements, and Form 16. The assessment may be conducted in person or through the e-filing portal.

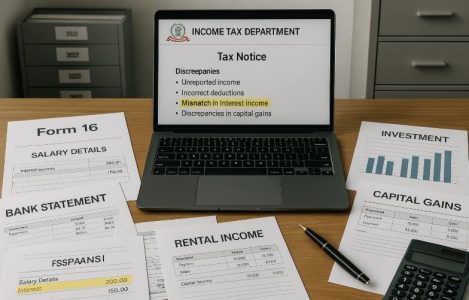

4. Notice under Section 148 – Income Escaping Assessment

If the Income Tax Department believes that you have not declared some income or there are under-reported earnings, a notice under Section 148 is issued. This is often termed as “Income Escaping Assessment.”

Scenarios for issuing Section 148:

- Unreported interest income from fixed deposits.

- Capital gains were not declared during filing.

- Rental income not disclosed in the ITR.

To respond, you must file a fresh return for the specific assessment year and provide accurate details of the unreported income.

5. Notice under Section 156 – Demand Notice

A demand notice under Section 156 is issued when the department determines that you have outstanding tax liabilities. This notice outlines the specific amount due and the deadline for payment.

Common reasons for a demand notice:

- Underpayment of advance tax.

- Mismatches in tax credits.

- Penalties for late filing or inaccurate returns.

You are required to pay the demand amount within 30 days of receiving the notice. Failure to do so may result in interest and further legal action.

6. Notice under Section 245 – Set-off of Refunds

This notice is sent when the department intends to adjust your tax refund against any outstanding dues from previous years. The notice is a way to inform you of the adjustment before it is executed.

What to do if you receive this notice:

- Verify the outstanding amount mentioned.

- If discrepancies are found, you can raise a query on the e-filing portal.

- If the calculation is correct, the refund will be adjusted automatically.

Understanding these different types of notices helps in timely action, reducing the risk of penalties and ensuring compliance with tax regulations.

What Are the Common Reasons for Receiving an Income Tax Notice?

While the specific reason for receiving an income tax notice can vary, some common causes are frequently observed among salaried employees. Identifying these causes can help you avoid mistakes and respond appropriately.

1. Mismatch in Salary Details and Tax Filing

Discrepancies between the salary details mentioned in Form 16 and the actual ITR filing can trigger a notice. This typically happens when allowances, bonuses, or other earnings are not accurately reported.

2. Failure to Report Additional Income

Salaried employees sometimes forget to declare additional income such as:

- Interest earned from savings or fixed deposits.

- Rental income from property.

- Capital gains from investments.

3. Discrepancies in TDS or Tax Credits

If there are mismatches between the TDS deducted by your employer and the amount reflected in Form 26AS, it may result in a notice. This usually happens when the employer delays updating TDS information.

4. Errors in ITR Filing

Simple mistakes like incorrect PAN details, wrong bank account numbers, or calculation errors can trigger a notice. Ensuring accuracy during the initial filing can prevent such notices.

How to Respond to an Income Tax Notice?

Receiving a tax notice can be intimidating, but understanding the process to respond can make it manageable. Follow these steps to address the notice correctly:

1. Understand the Type of Notice

Read the notice carefully to identify its purpose and the section under which it is issued. This will help you understand what action is required.

2. Verify the Details and Assessment Year

Check the assessment year and cross-verify the information with your records to identify any mismatches or errors.

3. Log in to the Income Tax e-Filing Portal

Access the “e-Proceedings” section to find details about the notice. You can respond, upload documents, or seek clarification online.

4. Gather Supporting Documents

Depending on the nature of the notice, you may need:

- Form 16 and salary slips.

- Bank statements and investment proofs.

- TDS certificates and Form 26AS.

5. Submit Your Response Online

Follow the portal instructions to submit your explanation or correct the discrepancies.

Documentation Required for Responding

When responding to an income tax notice, having the right documentation is crucial. Proper and organised documentation not only speeds up the resolution process but also minimises the chances of further queries from the Income Tax Department. Below are the primary documents that salaried employees should keep ready:

1. Form 16 and Salary Slips

Form 16 is the most important document for salaried employees, as it contains:

- Details of your salary, including allowances and deductions.

- TDS deducted by your employer.

- Taxable income after deductions under Chapter VI-A (like Section 80C, 80D).

Salary slips are also important as they reflect your monthly earnings and deductions, including Provident Fund (PF) contributions, professional tax, and more.

2. Bank Statements and Investment Proofs

Income from interest, mutual funds, and other investments needs to be accounted for accurately. Bank statements help verify:

- Interest earned from savings accounts or fixed deposits.

- Dividends received from investments.

- Any large transactions that may attract scrutiny.

Investment proofs include:

- Receipts for Life Insurance Premiums.

- Public Provident Fund (PPF) contributions.

- ELSS investments and National Savings Certificates (NSC).

3. Tax Payment Receipts and Acknowledgements

If you have made any self-assessment tax payments or advance tax payments, make sure you have:

- Challan receipts for proof of payment.

- Acknowledgement slips of ITR filing.

These receipts are crucial if there is a demand notice (Section 156) claiming unpaid dues.

4. Form 26AS (Tax Credit Statement)

Form 26AS is an annual tax statement that shows:

- TDS deducted on your income.

- Advance tax payments made.

- Self-assessment tax payments.

Cross-checking Form 26AS with your ITR is vital to identify discrepancies before responding to a tax notice.

5. Rental Agreements and Property Documents

If you have rental income, keep rental agreements and payment receipts ready. If you own multiple properties, property tax receipts and ownership documents may also be necessary.

6. Capital Gains Documentation

For any capital gains declared or noticed by the IT Department, supporting documents such as:

- Share trading reports.

- Property sale agreements.

- Mutual fund redemption statements.

Having these documents prepared will streamline your response and prevent delays in communication with the tax authorities.

Penalties and Consequences of Non-Compliance

Ignoring an income tax notice is not advisable, as it can lead to serious financial and legal consequences. Understanding the implications helps you take corrective measures promptly.

1. Financial Penalties

The Income Tax Department imposes fines for non-compliance, including:

- Late response to notices may attract a fine of up to £1,000 depending on the severity.

- Non-payment of outstanding tax dues results in interest charged under Section 234A, 234B, and 234C.

- Failure to file revised returns after receiving a defective return notice (Section 139(9)) can render the original ITR invalid, leading to additional tax liabilities.

2. Legal Implications

Consistent non-compliance or deliberate evasion may attract legal action:

- Prosecution for tax evasion under Section 276C, which can lead to imprisonment for up to seven years.

- Attachment of property and bank accounts for recovery of dues.

3. Impact on Credit Scores and Future Filings

Unresolved tax notices and outstanding liabilities can negatively affect your credit score. This may hinder your ability to:

- Secure loans or credit cards.

- Avail of financial services in the future.

To avoid these outcomes, it is important to respond promptly and accurately to any notice received.

How to Avoid Future Income Tax Notices?

While it is not always possible to completely avoid income tax notices, there are steps that salaried employees can take to minimise the chances of receiving one. Adopting good tax practices ensures smoother tax filing experiences and less interaction with the tax authorities.

1. Accurate and Complete Filing

One of the primary reasons for receiving notices is incorrect or incomplete filing of ITR. Ensure that:

- All sources of income, including salary, investments, and rental earnings, are declared.

- Deductions under Section 80C, 80D, and others are claimed accurately.

- PAN details and bank account information are filled in correctly.

2. Regular Verification of TDS and Form 26AS

Before filing your ITR, always cross-check the following:

- Form 26AS: Ensure that the TDS deducted by your employer matches what is reflected in the form.

- Bank Statements: Verify interest income and other credits.

- Investment Statements: Cross-check mutual fund earnings, dividends, and capital gains.

3. Timely Rectification of Errors

If you notice discrepancies after filing your ITR, you can:

- File a revised return before the deadline.

- Submit an online rectification request under Section 154 if there are computational errors.

4. Prompt Response to IT Department Queries

If you receive an income tax notice, respond within the stipulated time to avoid penalties. Delayed responses may escalate the issue further.

5. Avoid Cash Transactions Beyond Limits

The IT Department closely monitors large cash transactions. To avoid scrutiny:

- Avoid cash deposits or withdrawals exceeding £10,000 in a single day.

- Use digital transactions for large payments to maintain traceability.

Following these guidelines not only keeps you compliant but also reduces the likelihood of tax-related disputes.

Conclusion

Handling an income tax notice as a salaried employee need not be intimidating if you are well-prepared and aware of the process.

Understanding the types of notices, the reasons behind them, and how to respond effectively can save you from unnecessary penalties and legal hassles.

Keep your documentation organised, verify your tax details carefully, and respond promptly to any communication from the Income Tax Department.

By maintaining compliance and being proactive, you can navigate through any tax notice smoothly and efficiently.

FAQs

What should I do if I do not agree with the notice?

If you do not agree with the contents of the notice, you can file a rectification request or respond with supporting documents that justify your claims.

Can I ignore a tax notice if I believe it was sent in error?

No, even if you believe the notice is erroneous, you must acknowledge and respond to it. Ignoring it may lead to penalties.

How long do I have to respond to an income tax notice?

Generally, the Income Tax Department provides 30 days to respond. Failing to meet the deadline may result in additional scrutiny or penalties.

What happens if I do not respond to a demand notice?

Non-response to a demand notice under Section 156 can lead to interest charges, asset attachment, or legal action.

Can I receive a notice even if my employer deducts TDS?

Yes, you can still receive a notice if there are discrepancies in income reporting, undeclared investments, or mismatches in Form 26AS.