In the Indian economic landscape of 2026, MSMEs are the engine of growth, but they are also the most vulnerable to “credit fragmentation.” It is common for a promoter to juggle a term loan from a PSU bank, a few high-interest fintech bridge loans, and multiple business credit card outstandings.

This leads to a “Debt Spiral” where cash flow is consumed by mismatched repayment cycles rather than business expansion. Business debt consolidation loans are the professional’s answer to this crisis, merging expensive, scattered liabilities into a single, structured, and lower-interest facility.

Whats are the Top 10 Business Debt Consolidation Loans in India (2026)?

Lenders in 2026 have transitioned toward Cash-flow Based Lending. Below is a detailed breakdown of the top 10 products available for debt consolidation, categorized by their suitability for different business needs.

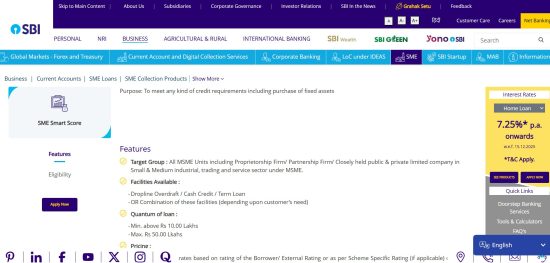

1. State Bank of India (SBI) – SME Smart Score

As the cornerstone of Indian banking, SBI’s SME Smart Score is the “Gold Standard” for businesses with tangible assets or a strong track record.

- Loan Amount: ₹10 Lakh to ₹50 Lakh.

- Interest Rate: Starts at 8.00% p.a. (linked to EBLR).

- Detailed Insight: This scheme uses a proprietary scoring model that considers 60% as the passing marks for eligibility. It is exceptionally cost-effective because it offers a margin of only 20% for working capital.

- Best For: Manufacturing units looking to move away from high-interest private NBFC loans.

2. HDFC Bank – Business Loan Balance Transfer

HDFC dominates the private sector with a “fast-track” balance transfer mechanism specifically designed to poach high-interest debt from competitors.

- Loan Amount: Up to ₹75 Lakh.

- Interest Rate: 10.75% to 22.50% p.a.

- Detailed Insight: HDFC offers a Dropline Overdraft facility as part of the consolidation. This means your limit drops monthly along with your EMI, but you only pay interest on the amount you actually use.

- Best For: Service sector SMEs and retailers who need an “Emergency Fund” along with their consolidation.

3. ICICI Bank – Insta Secured Overdraft

ICICI’s Insta OD is the fastest secured product in 2026, leveraging a 100% digital journey through the InstaBiz app.

- Loan Amount: Up to ₹2 Crore (Secured against Property/FD).

- Interest Rate: 8.5% to 14.5% p.a.

- Detailed Insight: If you have an existing current account with ICICI, the approval is nearly instantaneous. The USP is the Auto-Renewal feature, the bank reviews your account conduct every 12 months and automatically renews the limit without fresh documentation.

- Best For: Tech-savvy entrepreneurs with residential property looking for immediate relief.

4. Bajaj Finserv – Flexi Term Loan

Bajaj Finserv is the pioneer of “Hybrid” loans in India. Their Flexi model is designed for businesses with unpredictable cash flows.

- Loan Amount: Up to ₹80 Lakh.

- Interest Rate: 14% to 24% p.a.

- Detailed Insight: This loan allows for Unlimited Part-Prepayments at no extra cost. If your business receives a bulk payment, you can park it in the loan account to reduce interest, and withdraw it again if an emergency arises.

- Best For: Consolidating multiple short-term fintech loans into one manageable line of credit.

5. IDFC FIRST Bank – FIRSTmoney Business Loan

IDFC FIRST Bank focuses heavily on the “New-to-Credit” and “Small SME” segment with ultra-transparent pricing.

- Loan Amount: ₹7 Lakh to ₹1 Crore.

- Interest Rate: Starting at 12.99% p.a.

- Detailed Insight: They are among the few who offer Zero Foreclosure Charges after a certain period (check your specific sanction letter). Their 2026 digital interface allows you to link your GST and Bank Statements via “Account Aggregator” for an offer within minutes.

- Best For: Consolidating credit card debts and small-ticket unsecured loans.

6. Axis Bank – 24×7 MSME Digital Loan

Axis Bank uses a Custom Underwriting Approach, looking at segment-specific data (e.g., healthcare, education, or logistics).

- Loan Amount: ₹1 Crore to ₹25 Crore (Secured).

- Interest Rate: Competitive rates based on property type (Residential/Commercial/Industrial).

- Detailed Insight: Axis is aggressive with Balance Transfer + Top Up. If you have an existing loan of ₹1 Crore, Axis will take it over and give you an additional ₹50 Lakh at the same low rate to close other debts.

- Best For: Mid-sized industries needing a massive infusion of capital to clean up their balance sheet.

7. Kotak Mahindra Bank – Business Loan Against Property (LAP)

Kotak is known for its conservative yet deeply supportive lending for established families and 2nd-generation businessmen.

- Loan Amount: ₹10 Lakh to ₹5 Crore.

- Interest Rate: 9.50% p.a. onwards.

- Detailed Insight: Kotak accepts a wide variety of collaterals, including Industrial plots and banquet halls. They offer tenure up to 15 years, which is significantly higher than the 3–5 years offered for unsecured loans.

- Best For: Massive debt restructuring where long tenures are required to bring down the monthly EMI.

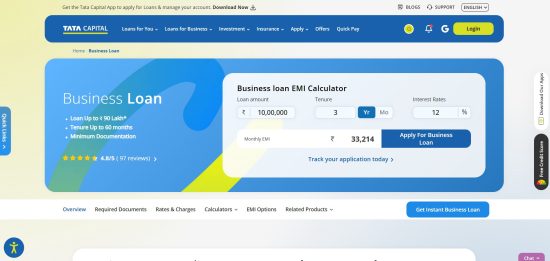

8. Tata Capital – Structured Business Loans

The “Tata” brand brings trust and a unique “Structured EMI” plan where your payments align with your revenue cycles.

- Loan Amount: Up to ₹90 Lakh (Unsecured).

- Interest Rate: Starting from 12% p.a.

- Detailed Insight: They require a CIBIL score of 675+, making them slightly more flexible than HDFC or SBI. Their “Step-up” EMI plan allows you to pay lower EMIs in the first year and increase them as your business grows.

- Best For: Startups and SMEs that have just turned profitable and need to restructure debt to scale.

9. SMFG India Credit (formerly Fullerton India)

SMFG excels in the “Under-banked” segments of Tier 2 and Tier 3 cities across India.

- Loan Amount: Up to ₹75 Lakh.

- Interest Rate: 13% to 33% p.a.

- Detailed Insight: While their interest rates are higher, their Eligibility Norms are broader. They accept “Unlisted Companies” and “Hospitals run by Trusts,” which many traditional banks avoid.

- Best For: Local traders and small manufacturers who may not have perfect “Bankable” profiles but have strong local cash flows.

10. IndusInd Bank – Business Installment Loan

IndusInd offers a “Doorstep Service” model combined with a very high age eligibility (up to 70 years).

- Loan Amount: Up to ₹50 Lakh.

- Interest Rate: 13% to 22% p.a.

- Detailed Insight: They offer a Fixed Rate of Interest, which is rare in 2026. This protects your business from interest rate hikes by the RBI for the entire 4-year tenure.

- Best For: Conservative business owners who want a fixed, unchangeable repayment schedule.

What is the Step-by-Step Documentation Checklist for 2026?

To ensure a high “First-Time Right” approval rate, keep these documents ready in digital format (PDF/XML via Account Aggregator).

Phase 1: Identity & Entity Proof

- Promoter Documents: PAN, Aadhaar (Linked to Mobile for e-KYC).

- Udyam Registration Certificate: Mandatory for MSME benefits in 2026.

- Entity Proof: Partnership Deed / MOA & AOA / GST Certificate.

Phase 2: Financial & Tax Documents

- GST Returns: Last 12 months (GSTR-3B and GSTR-1).

- Banking: Last 12 months’ bank statements for ALL active accounts.

- ITR: Last 3 years’ Income Tax Returns with Computation of Income.

- Audited Financials: Balance Sheet and P&L for the last 3 years (including Audit Reports 3CD/3CB).

Phase 3: The “Consolidation” Specifics

- Debt Schedule: A self-certified list of all current loans, outstanding amounts, and EMIs.

- Sanction Letters: Copies of existing loan agreements you wish to close.

- Foreclosure Letters: (Optional at application stage, but mandatory for disbursement).

What Does the 2026 Compliance Note Say About RBI Fair Lending Practices?

Under the latest RBI 2026 Guidelines, every lender must provide you with a Key Fact Statement (KFS). This document is your most powerful tool.

It must clearly list:

- The APR (Annual Percentage Rate): The real cost of the loan including fees.

- Penal Charges: These must now be “Reasonable” and cannot be capitalized (interest on penalties is prohibited).

- Grievance Redressal: The contact info for the Nodal Officer must be on your sanction letter.

Conclusion

Debt consolidation is not a sign of failure; it is a sign of financial maturity. In the competitive Indian market of 2026, the businesses that survive are not those with the most debt, but those with the most efficient debt.

By moving your liabilities into one of the Top 10 Business Loans mentioned above, you reduce your administrative burden, protect your CIBIL score, and most importantly, free up the cash flow needed to seize new opportunities.

Final Tip: Before signing any document, ask for the “Blended Interest Rate” and the “Key Fact Statement” as mandated by the RBI.

FAQ about “Business Debt Consolidation Loans”

How does the 2026 “Account Aggregator” (AA) framework help in consolidation?

Instead of manually collecting bank statements, you can “consent” to share your data digitally via an AA. This speeds up the processing time from 7 days to 24 hours.

Can I consolidate a loan that is in an NPA (Non-Performing Asset) status?

Direct consolidation is very difficult for NPAs. However, you can look for “Stressed Asset Restructuring” through SIDBI or specialized ARCs (Asset Reconstruction Companies).

What is the “Breakeven” point in debt consolidation?

Your breakeven is reached when the total interest saved over the new loan tenure is greater than the Foreclosure Charges (3-4%) + Processing Fees (1-2%) + GST (18%) of the new loan.